designcornerke.site Tools

Tools

How To Calculate Capitalisation Rate

According to Rasti Nikolic, a financial consultant at Loan Advisor, “in general though, 5% to 10% rate is considered good. Property investors use cap rate every. First off, what are cap rates? · Gross income – expenses = net income · Divide net income by purchase price · Move the decimal 2 spaces to the. Determine your commercial property's capitalization rate with our cap rate calc. Cap rates are critical for assessing the profitability of an investment. The Cap Rate is calculated by dividing the Net Operating Income (NOI) by the current market value of the property. Here's an example of how to calculate the cap. Now that you know the amount of your net annual income from the property, you're ready to calculate your real estate cap rate. To find the cap rate, you'll need. It is commonly used as a measurement to compare like properties for appraisal valuations or other comparative analysis. A cap rate is calculated by dividing the. How to Calculate Cap Rate. The cap rate is calculated by dividing a rental property's net operating income (NOI) by its market value as of the present date. The cap rate is calculated by taking the net operating income of the property in question and dividing it by the market value of the property. The resulting cap. Cap rates are calculated by dividing a property's net operating income (NOI) by its current market value. Cap rates can provide valuable insight into a property. According to Rasti Nikolic, a financial consultant at Loan Advisor, “in general though, 5% to 10% rate is considered good. Property investors use cap rate every. First off, what are cap rates? · Gross income – expenses = net income · Divide net income by purchase price · Move the decimal 2 spaces to the. Determine your commercial property's capitalization rate with our cap rate calc. Cap rates are critical for assessing the profitability of an investment. The Cap Rate is calculated by dividing the Net Operating Income (NOI) by the current market value of the property. Here's an example of how to calculate the cap. Now that you know the amount of your net annual income from the property, you're ready to calculate your real estate cap rate. To find the cap rate, you'll need. It is commonly used as a measurement to compare like properties for appraisal valuations or other comparative analysis. A cap rate is calculated by dividing the. How to Calculate Cap Rate. The cap rate is calculated by dividing a rental property's net operating income (NOI) by its market value as of the present date. The cap rate is calculated by taking the net operating income of the property in question and dividing it by the market value of the property. The resulting cap. Cap rates are calculated by dividing a property's net operating income (NOI) by its current market value. Cap rates can provide valuable insight into a property.

A simple formula for calculating the capitalization rate is annual net operating income divided by the market value of a property and it declines as values rise. The capitalization rate, also known as cap rate, is mostly used in CRE to indicate the rate of return, but it can also measure the level of risk that a. The cap rate, expressed as a percentage, estimates a property's annual net income relative to the home's market value. Therefore, a % cap rate suggests an. Cap rate is calculated by dividing the Net Operating Income (NOI) by the current market value of the property. The resulting percentage is the cap rate. This. Calculated by dividing a property's net operating income by its asset value, the cap rate is an assessment of the yield of a property over one year. For example. The capitalization rate of a property is determined by dividing the Net Operating Income (NOI) by its current market value. Cap Rate Formula. Cap rate = Net. Average cap rates range from 4% to 10%. Generally, the higher the cap rate, the higher the risk. A cap rate above 7% may be perceived as a riskier investment. Capitalization rate (or "cap rate") is a real estate valuation measure used to compare different real estate investments. Although there are many variations. The difference usually stems from the calculation of net operating income. For example, the income could be calculated on a pro- forma basis (i.e., estimated. An infographic explaining the cap rate formula: Cap rate equals net operating income divided by How to Calculate Your Property's Assessed Value. Group. Using the cap rate equation of NOI (75,)/property value (1,,,) you would get a cap rate of %. You can then easily compare to other cap rates in the. You then divide your net operating income by the property's current fair market value (we'll use the list price of $,) to get the cap rate: $18,/$. Property value isn't always known at the time of calculation so it could be represented by a value estimate, purchase price, or appraised value. For example, if. Now, capitalization Rate Calculation = NOI/Property price = $10,/$80, = %. Advantages. Let us understand the advantages of the real estate. It's typically expressed as a percentage and is calculated by dividing the property's net income by its purchase price or current market value. For example, if. To calculate the cap rate, you would divide the property's net operating income by its market value. The NOI is calculated by subtracting the operating expenses. The cap rate is the ratio between the net income of the property and its original price or capital cost. Cap rate is expressed as a percentage. [5] X Research. The Capitalization Rate, or Cap Rate, is defined as the percentage rate used to estimate the value of an investment asset by converting the net operating. Step-by-Step Guide: How to Calculate Cap Rate As mentioned earlier, NOI is the annual income generated by a property after deducting operating expenses. To. A cap rate can be defined as a discount rate minus the expected long- term growth rate of future income. Therefore, to calculate a cap rate, one must first.

What Is The Maximum Amount For 401k

Other limits. For , the maximum amount of annual compensation that can be taken into account when determining employer and employee contributions is. Defined Benefit Plans, $,, $, ; Defined Contribution Plans (annual additions limit), $69,, $66, ; Annual Compensation Limit, $,, $, Employees can invest more money into (k) plans in , with contribution limits increasing from $ in to $ in The (c) contribution limit applicable to defined contribution retirement plans increased from $66, to $69, Elective Deferrals (k)/(b) - (g). Contribution limits for (k) plans · Employee pre-tax and Roth contributions · $22, ; Contribution limits for (b) plans · Employee pre-tax and Roth. The maximum k contribution limit is $ for , up from $ for The limit tends to increase with inflation over time. In , self-employed individuals can contribute up to $ to a solo (k) (or up to $ if at least age 50) plus up to 25% of compensation as an. The annual maximum for is $23, If you are age 50 or over, a 'catch-up' provision allows you to contribute an additional $7, into your account. The. Roth (k) contribution limits. The maximum amount you can contribute to a Roth (k) for is $23, if you're younger than age This is an extra. Other limits. For , the maximum amount of annual compensation that can be taken into account when determining employer and employee contributions is. Defined Benefit Plans, $,, $, ; Defined Contribution Plans (annual additions limit), $69,, $66, ; Annual Compensation Limit, $,, $, Employees can invest more money into (k) plans in , with contribution limits increasing from $ in to $ in The (c) contribution limit applicable to defined contribution retirement plans increased from $66, to $69, Elective Deferrals (k)/(b) - (g). Contribution limits for (k) plans · Employee pre-tax and Roth contributions · $22, ; Contribution limits for (b) plans · Employee pre-tax and Roth. The maximum k contribution limit is $ for , up from $ for The limit tends to increase with inflation over time. In , self-employed individuals can contribute up to $ to a solo (k) (or up to $ if at least age 50) plus up to 25% of compensation as an. The annual maximum for is $23, If you are age 50 or over, a 'catch-up' provision allows you to contribute an additional $7, into your account. The. Roth (k) contribution limits. The maximum amount you can contribute to a Roth (k) for is $23, if you're younger than age This is an extra.

Maximum individual contribution and catch-up contribution limits for · For , the regular IRA or Roth IRA contribution limit is $7, Eligible. (k) contribution limits are limits placed by the US Congress on the amount of money that employees can contribute toward their retirement plan. The (k) contribution limit for is $22, for employee contributions and $66, for combined employee and employer contributions. If you're age 50 or. This limit increases to $76,5($73, for ; $67, for ; $64, for ; and $63,5if you include catch-up contributions. Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that. The (k) contribution limit for employees was $22, For , employees may contribute up to $23, Contributuion limits table: Age(k) only, (k) with Profit Sharing, Cash Balance, Total Maximum annual contribution amounts for the cash balance. Your contribution (or “deferral”) limit depends, in part, on your age by year-end. If you turn 50 years old by the end of the year, the IRS allows you to make a. For (k) accounts, the contribution limit is $, or $ for employees over For traditional and Roth IRA plans, the limit is $ Other limits. For , the maximum amount of annual compensation that can be taken into account when determining employer and employee contributions is. Annual (k) contribution limits are currently $19,, but employees 50 and older are eligible to make an additional $6, in catch-up contributions. The (c) contribution limit applicable to defined contribution retirement plans increased from $66, to $69, · The (a)(17) annual compensation limit. K. Workers younger than age 50 can contribute a maximum of $20, to a (k) in That's up $1, from the limit of $19, in In , the basic contribution limit was $19,; however, for , the IRS raised this limit by $1,, making it $20, Also, this limit is for your total. Your contribution (or “deferral”) limit depends, in part, on your age by year-end. If you turn 50 years old by the end of the year, the IRS allows you to make a. The limit on contributions to the (k) Plan is 75% of reportable gross annual compensation - up to a dollar limit of $23, for calendar year ; $30, New (k) Contribution Limits for · The (k) contribution limit is $22, · The (k) catch-up contribution limit is $7, for those age 50 and. The maximum k contribution limit is $ for , up from $ for The limit tends to increase with inflation over time. Total Contribution Limit. The calendar-year limit on total contributions is either % of your compensation or $61,, whichever is less, and may be adjusted. The limit on contributions to the (k) Plan is 75% of reportable gross annual compensation - up to a dollar limit of $23, for calendar year ; $30,

S&P Sector Performance

See S&P sectors on a cutting-edge financial platform. Check out the performance of various sectors of the US economy. With ES futures, you can take positions on S&P performance electronically. Interested in learning more? Connect with a member of our team to see how ES. Sector SPDRs are subject to risk similar to those of stocks including those regarding short selling and margin account maintenance. Latest Sector News ; Updated 7 minutes ago SEC's WhatsApp Probe Expands as Moody's, S&P Hit With Fines ; Updated 31 minutes ago Nvidia Gets DOJ Subpoena in. cap. Share map. Map Filter. S&P · World · Full · Exchange Traded Funds. 1-Day Performance. AAgilent Technologies Inc. AALAmerican Airlines Group Inc. AAPL. See the historical performance of the S&P Index. Learn more about the factors that affect the S&P average return. Sector performance ; S&P Consumer Staples Sector, +%, +% ; S&P Health Care Sector, +%, +% ; S&P Utilities Sector, +%, +% ; S&P. Sector performance ; Materials, , ; Real Estate, , ; Utilities, , ; S&P index performance for the trailing six or 12 months (%), The Stock Market & Sector Performance page gives you a quick glance at the overall state of the U.S. market segments. A 1-year chart of the S&P Index. See S&P sectors on a cutting-edge financial platform. Check out the performance of various sectors of the US economy. With ES futures, you can take positions on S&P performance electronically. Interested in learning more? Connect with a member of our team to see how ES. Sector SPDRs are subject to risk similar to those of stocks including those regarding short selling and margin account maintenance. Latest Sector News ; Updated 7 minutes ago SEC's WhatsApp Probe Expands as Moody's, S&P Hit With Fines ; Updated 31 minutes ago Nvidia Gets DOJ Subpoena in. cap. Share map. Map Filter. S&P · World · Full · Exchange Traded Funds. 1-Day Performance. AAgilent Technologies Inc. AALAmerican Airlines Group Inc. AAPL. See the historical performance of the S&P Index. Learn more about the factors that affect the S&P average return. Sector performance ; S&P Consumer Staples Sector, +%, +% ; S&P Health Care Sector, +%, +% ; S&P Utilities Sector, +%, +% ; S&P. Sector performance ; Materials, , ; Real Estate, , ; Utilities, , ; S&P index performance for the trailing six or 12 months (%), The Stock Market & Sector Performance page gives you a quick glance at the overall state of the U.S. market segments. A 1-year chart of the S&P Index.

All Sectors. % ; Consumer Staples. +% ; Real Estate. +% ; Utilities. % ; Health Care. %.

In depth view into S&P including performance, historical levels from , charts and stats. The differences in returns for the 11 S&P sectors support two fundamental principles of financial planning – asset allocation and diversification. The S&P is down a staggering $ trillion in the market implosion since mid-July. But some investors are dodging the pain. Still, investors use the S&P as the main index to measure their portfolios' performance, with roughly $ trillion benchmarked to the S&P The S&P's. The chart breaks down the annual S&P sector returns, ranked best to worst over the past fifteen years. There are many factors that impact stock market returns, but one common concern of investors is how the stock market will be impacted by a change in. The SPDR® S&P ® ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P. Which are the S&P Sectors with the highest returns? Find out and use them to build your perfect lazy portfolio with ETFs. Over 90% of the year-to-date return of the S&P Index through September has come from the 10 stocks with the highest weightings in the Index. There is no. What are the S&P Sectors? · 1. Information Technology. The information technology – IT – sector consists of companies that develop or distribute technological. Sector Watch Chart ; INDUSTRIALS. 1,, + ; MATERIALS. , + ; REAL ESTATE. , + ; TECHNOLOGY. 4,, + Sector Watch Chart ; ENERGY. , + ; FINANCIALS. , + ; HEALTH. 1,, + ; INDUSTRIALS. 1,, + SECTOR SPDR ETFs. Unique Exchange Traded Funds (ETFs) that divide the S&P into eleven sector index funds Performance topic. Past performance does not. Laggards: · Communication Services = % · Utilities = % · Consumer Staples = %. ASSET CLASS PERIODIC TABLE OF RETURNS ( We use "Sector / S&P " to represent sector performance. This chart shows S&P 's sector rotation. Yahoo, eBay, Amazon and Google were founded in the. Each S&P Sector can be "expanded" to view its industries (or sub-sectors) where you can view how each of these contribute to the overall sector performance. The. Invests in stocks in the S&P Index, representing of the largest U.S. companies. · Goal is to closely track the index's return, which is considered a. This interactive chart shows the running percentage gain in the S&P by Presidential term. Each series begins with the closing value of the month of. Stock Market Historical Patterns. S&P Historical Monthly & Annual Returns · January Barometer · S&P & Presidential Cycles · S&P & Geopolitical. S&P Index ; YTD Change. % ; 12 Month Change. % ; Day Range5, - 5, ; 52 Wk Range4, - 5, ; Total Components

Usd Wallet App

USD Coin wallet for any device: an app for iOS and Android and a desktop version for all browsers. Use StormGain's USDC wallet and get a 10% bonus! Buy, sell, hold, and transfer PayPal USD in our app or on our site. Send it to friends in the US on PayPal without fees. Or send to Ethereum and Solana wallet. Buy and sell USDC Stablecoin with the Exodus USD Coin Wallet. Easily and instantly swap USDC for your favorite cryptos right in our USDC wallet app. All Tether tokens (USD₮) are pegged at 1-to-1 with a matching fiat currency and are backed % by Tether's reserves. We publish a daily record of the current. Click the “Buy” icon in the “Actions” tab of the Zengo app in order to browse available payment methods and providers. Holding and Storing PYUSD. Zengo. S-Wallet is a multi-currency cryptocurrency wallet that allows each user to store crypto and fiat assets in a single secure vault. Store and manage your USD Coin Wallet (USDC) in a user-friendly cryptocurrency wallet for iOS and Android with multi-level protection. Your Premier Digital Wallet for digital dollar. Experience speed, security, and the power of USDC to manage your finance effortlessly. Payperless wallet for receiving, sending and storing USD Coin is an advanced mobile application that allows you to store and use your cryptocurrency to pay and. USD Coin wallet for any device: an app for iOS and Android and a desktop version for all browsers. Use StormGain's USDC wallet and get a 10% bonus! Buy, sell, hold, and transfer PayPal USD in our app or on our site. Send it to friends in the US on PayPal without fees. Or send to Ethereum and Solana wallet. Buy and sell USDC Stablecoin with the Exodus USD Coin Wallet. Easily and instantly swap USDC for your favorite cryptos right in our USDC wallet app. All Tether tokens (USD₮) are pegged at 1-to-1 with a matching fiat currency and are backed % by Tether's reserves. We publish a daily record of the current. Click the “Buy” icon in the “Actions” tab of the Zengo app in order to browse available payment methods and providers. Holding and Storing PYUSD. Zengo. S-Wallet is a multi-currency cryptocurrency wallet that allows each user to store crypto and fiat assets in a single secure vault. Store and manage your USD Coin Wallet (USDC) in a user-friendly cryptocurrency wallet for iOS and Android with multi-level protection. Your Premier Digital Wallet for digital dollar. Experience speed, security, and the power of USDC to manage your finance effortlessly. Payperless wallet for receiving, sending and storing USD Coin is an advanced mobile application that allows you to store and use your cryptocurrency to pay and.

designcornerke.site is the only app that lets you buy crypto with a card or bank account and self-custody your assets—all in one place. Power US dollar payments and financial services in your app globally. Integrate USDC using flexible, enterprise-grade tools and your preferred languages. Visit. Buy with your credit card, payment app, or bank account. Instantly swap between cryptocurrencies. Protect your returns by trading into USD stablecoins. Access your money no matter when, no matter where. Our fast and secure app lets you move your account balance 24/7, worldwide. Create USDC wallet to transform your crypto experience with Guarda multi-currency wallet. Buy, send, receive, and store your USDC quickly and securely. BitPay is the best crypto app to pay with crypto and accept crypto payments. Create a wallet to buy, store, swap and spend securely. Manage your cryptocurrency portfolio with BitPay's secure, open-source, non-custodial cryptocurrency wallet. With the BitPay Wallet, your private keys and. A USD Coin wallet is an Ethereum wallet that helps one manage USDC token funds. Wallets enable users to send, receive, and store cryptocurrency. It doesn't stop. The best USD Coin wallet on the market Your money with you around the world. Manage USD Coin and traditional money easily and quickly. Create as many wallets. Exodus Tether USD Mobile Wallet. Secure, manage, and swap your USDT with the mobile security of face or fingerprint scanning. Sync between the Tether USD. Free USD Coin (USDC) cryptocurrency wallet with 24/7 support. Easily create a USD Coin address, send, and exchange over + coins and tokens directly in. Today we're excited to launch USD Wallets, a new feature which allows users to store U.S. Dollar balances on Coinbase. Once you deposit USD into your new. Download and install the Ledger Live app in a couple of clicks on desktop and mobile. Coupled with a Ledger, it makes the most secured wallet for your USD Coin. Embrace the future of digital finance with our USDC wallet, an open-source, self-custodial mobile application. USDC, a trustworthy stablecoin. BitPay is the best crypto app to pay with crypto and accept crypto payments. Create a wallet to buy, store, swap and spend securely. Create USD Coin Wallet and experience all the advantages of mobile cryptocurrency wallets with our apps for iOS and Android. Your wallet is always ready for use. Download the BitPay crypto wallet app to securely buy, store, swap and spend multiple cryptocurrencies. Take full control of your finances with BitPay's. Power US dollar payments and financial services in your app globally. Integrate USDC using flexible, enterprise-grade tools and your preferred languages. Visit. Receive instant payments for free · Optimize foreign exchange · Send USD globally with no fees · Fund and withdraw in local currency. Free Tether USD (USDT) cryptocurrency wallet with 24/7 support. Easily create a Tether USD address, send, and exchange over + coins and tokens directly.

What Careers Make The Most Money

This is one of the best, highest-paying jobs for those who find joy in making others feel confident in their own skin. Dermatologists are skin care experts. Careers and Make More Money. Considering Going Back to College Most Popular Jobs by Major and Pay. Biology Majors · Economics Majors · Business. The top-paying careers are usually in medicine (surgeons, anesthesiologists), law (partners at big firms), finance (investment bankers, hedge. For most of my career, I had the mental model that my manager Earn money for your writing. Listen to audio narrations. Read offline. Got a passion for fitness and wellness? Why not make a career out of it? · Physical Education Teacher · Physical Therapy Assistant · Health Educator · Nutritionist. Careers: Part 8 · How Banning Employers from Asking About Salary History Could Help Close the Wage Gap · Robots That Will Save You Time and Money or Take Your Job. Identifying the Highest Paying Jobs · 1. Cardiologist: $, · 2. Anesthesiologist: $, · 3. Oral and Maxillofacial Surgeon: $, · 4. Emergency. Looking for a job? Download the Ultimate Guide To Jobs After Occupational Therapy School! · The highest paying settings · How to get bonuses and paid overtime. Highest-Paying Careers ; 1 · 1 · 1 ; Neurologists · Obstetricians and Gynecologists · Ophthalmologists, Except Pediatric. This is one of the best, highest-paying jobs for those who find joy in making others feel confident in their own skin. Dermatologists are skin care experts. Careers and Make More Money. Considering Going Back to College Most Popular Jobs by Major and Pay. Biology Majors · Economics Majors · Business. The top-paying careers are usually in medicine (surgeons, anesthesiologists), law (partners at big firms), finance (investment bankers, hedge. For most of my career, I had the mental model that my manager Earn money for your writing. Listen to audio narrations. Read offline. Got a passion for fitness and wellness? Why not make a career out of it? · Physical Education Teacher · Physical Therapy Assistant · Health Educator · Nutritionist. Careers: Part 8 · How Banning Employers from Asking About Salary History Could Help Close the Wage Gap · Robots That Will Save You Time and Money or Take Your Job. Identifying the Highest Paying Jobs · 1. Cardiologist: $, · 2. Anesthesiologist: $, · 3. Oral and Maxillofacial Surgeon: $, · 4. Emergency. Looking for a job? Download the Ultimate Guide To Jobs After Occupational Therapy School! · The highest paying settings · How to get bonuses and paid overtime. Highest-Paying Careers ; 1 · 1 · 1 ; Neurologists · Obstetricians and Gynecologists · Ophthalmologists, Except Pediatric.

Before sharing sensitive information, make sure you're on a federal government site. Careers at BLS · BLS Speakers Available · Errata · Contact BLS · Overview. Students must decide to study something that challenges and interests them while balancing the hard realities of the job market and outlook on career paths. A. To make the most of your next job, carefully consider how it will impact your finances holistically. “When someone changes jobs, they often have the. Highest Paying Jobs That Don't Require a College Degree ; 1. Physical Therapist Assistant ·: $49, ·: $37, to $80, ·: 33, new positions (24% job. Jobs That Make a Lot of Money (17 high-paying careers in ) · 1. Accountant · 2. Business Executive · 3. Computer System and IT Manager · 4. Engineer · 5. career, we want to hear from you. Come join a diverse team with one of the most elite law enforcement agencies in the world. Apply Now · New Opportunities. ALL. CAREERS. We Run For ALL. By helping provide food, fiber Your money. Your health. Your time. Your life. We take care of our most valuable resource: You. The highest-paid accountants earn $, or more per year, but even an average salary is still between $45, and $78, Better still, accountants can. The money and salaries behind the PGA and professional golf careers It's generally thought that Joe Maddon, Mike Scioscia, and Bruce Bochy make the most, at. Instead, all you really have to do is give up at most five years of your career to make things happen. money that doesn't make them greedy that makes them. Half of doctors in the US earn over $, per year, and the mean is actually higher than finance and law. That said, the very highest-earning people are in. One of them is the Military Career. This Career currently has the highest salary among all the other Careers. It has two branches, and Simmers can pick one of. Money Site Map» Careers. Careers: Part Before Team USA Women's Hockey Women Make the Most Money in These States · Fast-Rising CEOs Have These 4. 61 Most Fun Jobs That Pay Well in (Top Fun Careers). Looking How to Make Money From Home Using The Internet. Ways To Get Money · Money Making Jobs. Neurosurgeons, also known as neurological surgeons, are the highest-paid doctors. They diagnose and treat conditions of the brain, spine, and nervous system. One of the highest-paying work-from-home jobs, this physician-level role oversees the operations of a healthcare organization. The medical director creates. There are several careers that allow individuals to make a substantial amount of money while also doing something they love. One such career is. We need global thinkers to invent new ways to make money safe and accessible for all. Are you looking for a new job? Browse our careers. What Job Makes the Most Money With the Least Education? · Real Estate Broker · Small Business Owner (can't beat working for yourself!) · Sales Representative/. What are possible LinkedIn Careers - Top 7 Ways To Make Money from LinkedIn Pay Per Click is also one of the most easy way to earn money from.

Whats The Best High Yield Savings Account

Best High-Yield Savings Accounts – August · Top High-Yield Savings Accounts · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Reading up on personal finance? Looking for ways to maximize your savings and investments? Instantly compare the best accounts in Canada and boost your ROI. American Express National Bank savings account · ; Jenius Bank savings account · ; Forbright Bank savings account · ; LendingClub savings account · At % APY*, Connect High-Yield Savings gives you a higher interest rate to let your money grow faster - with the freedom to deposit or withdraw money at any. What is the Canada Life High Interest Savings Account? A savings account with a competitive interest rate issued by B2B Bank, a leading provider of banking. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. High Yield Savings Account · % APY · Expect more from your savings account. · Open a Direct Checking Account · Privacy Preference Center. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. Best High-Yield Savings Accounts – August · Top High-Yield Savings Accounts · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Reading up on personal finance? Looking for ways to maximize your savings and investments? Instantly compare the best accounts in Canada and boost your ROI. American Express National Bank savings account · ; Jenius Bank savings account · ; Forbright Bank savings account · ; LendingClub savings account · At % APY*, Connect High-Yield Savings gives you a higher interest rate to let your money grow faster - with the freedom to deposit or withdraw money at any. What is the Canada Life High Interest Savings Account? A savings account with a competitive interest rate issued by B2B Bank, a leading provider of banking. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. High Yield Savings Account · % APY · Expect more from your savings account. · Open a Direct Checking Account · Privacy Preference Center. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today.

Best high-yield savings account rates of August ; Jenius Bank. Jenius Savings Account · % ; SoFi Bank, N.A.. SoFi Checking and Savings · % ; Vio Bank. Sallie Mae named one of the best savings accounts, money market accounts and CDs for GOBankingRates named Sallie Mae as one of the top online banks. If you want to earn the maximum amount on your savings, you might consider opening an account at Simplii Financial. This online bank is currently promoting and. What is a high interest savings account? A high interest savings account We can help steer your finances in the right direction. Learn about our. The first to catch my eye was BMO Alto. BMO Alto offers a very nice % yearly return. But unfortunately some searching on reddit showed tons of complaints. When you open an account, many banks make you choose between a great interest rate, no-fee banking, a full suite of banking features and easy access to cash. Created especially for those new to Advantis, our free New Members Savings account couldn't be simpler. And our current annual percentage yield (APY) of %*. The high-yield savings account from Cloudbank 24/7 offers a market-leading %% APY with no fees and a very low minimum opening deposit of $1. Cloudbank is a. With the Western Alliance Bank High-Yield Savings Premier account, you can enjoy FDIC insurance and no fees3 while earning a much higher return on your money. Explore our highest-yield savings account, with no monthly account fee, no limit to your earnings, and easy mobile and online access. Jenius Savings Account is a good choice if you're interested in an individual or joint savings account. Jenius Bank doesn't require a minimum opening deposit. The Varo High-Yield Savings Account is packed with benefits to help you reach your financial goals. In addition to earning % APY without charging a monthly. Balances are federally insured for at least $, Who uses a high-yield savings account and why? An HYSA is a good option for almost everyone with savings. With Popular Direct Select Savings, you get a high-yield savings account that can help you grow your online savings. Put your money to work today. Earn more than 10x the national average rate and reach your savings goal faster with Citadel's High Yield Savings Account. You'll benefit from a great rate. Best High-Yield Savings Accounts for August ; Capital One Performance Savings · APY: %; No minimum opening balance or monthly maintenance fee ; Ally. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. Put your savings to work with a Gate City Bank high yield savings account, offering our best interest rates with no monthly fees. Here's a closer look! For high-yield savings accounts opened through Raisin, however, there are no minimum balance requirements, no maintenance fees, and no withdrawal fees. What is. Earn more interest with a high yield savings account · High-Rate Savings Account Features · Bank on your terms with Alliant's high interest online savings account.

What Do I Need For Crypto Mining

Crypto mining is a process blockchain networks, like Bitcoin and other cryptocurrencies, use to finalize transactions. It's called mining because this. Need help? NiceHash. World's leading. Hashpower marketplace. Connect your miners and earn Bitcoin for every share. PC,GPU & CPU mining. Earn Bitcoin with your. Bitcoin miners receive bitcoin as a reward for creating new blocks which are added to the blockchain. Mining rewards can be hard to come by due to the intense. Crypto mining requires a strategic approach to be profitable in the increasingly competitive mining market. We give you all the blockchain data you need. Crypto mining is the process by which crypto miners use computers, data, codes, and calculations to validate crypto currency transactions and earn. Bitcoin mining is the process for validating Bitcoin transactions and minting new coins. Since Bitcoin is decentralized, there's no central authority managing. Mining cryptocurrencies requires computers with special software specifically designed to solve complicated, cryptographic mathematic equations. In the. Mining rigs are most commonly used to mine Bitcoin, which has over 99% of the market share in computing power backing it, out of all Proof of Work-based. You'll first need to acquire an ASIC miner optimized for Bitcoin, such as one produced by Bitmain or Whatsminer. New top-end ASICs start at about $3, to. Crypto mining is a process blockchain networks, like Bitcoin and other cryptocurrencies, use to finalize transactions. It's called mining because this. Need help? NiceHash. World's leading. Hashpower marketplace. Connect your miners and earn Bitcoin for every share. PC,GPU & CPU mining. Earn Bitcoin with your. Bitcoin miners receive bitcoin as a reward for creating new blocks which are added to the blockchain. Mining rewards can be hard to come by due to the intense. Crypto mining requires a strategic approach to be profitable in the increasingly competitive mining market. We give you all the blockchain data you need. Crypto mining is the process by which crypto miners use computers, data, codes, and calculations to validate crypto currency transactions and earn. Bitcoin mining is the process for validating Bitcoin transactions and minting new coins. Since Bitcoin is decentralized, there's no central authority managing. Mining cryptocurrencies requires computers with special software specifically designed to solve complicated, cryptographic mathematic equations. In the. Mining rigs are most commonly used to mine Bitcoin, which has over 99% of the market share in computing power backing it, out of all Proof of Work-based. You'll first need to acquire an ASIC miner optimized for Bitcoin, such as one produced by Bitmain or Whatsminer. New top-end ASICs start at about $3, to.

How Should Crypto Miners Report Income? When reporting income from crypto mining on your taxes, you'll need to first make a determination on whether your mining. If you want to mine other cryptocurrencies, the Bitmain Antminer KS3, Bitmain Antminer D9, and Bitmain Antminer K7 are all solid choices. Bitcoin mining. Bitcoin mining is an arduous process, especially these days. In order to incentivize that work, miners are rewarded in bitcoin each time they mine a block. This. Mining is what keeps the Bitcoin network running by creating new blocks on the chain and verifying Bitcoin transactions. · Transactions are verified by miners. Many of the most popular choices cost $1, or more. Depending on the cryptocurrency you mine and how its price changes, breaking even on your mining device. Best Cryptocurrencies to Mine · 1. Bitcoin (BTC) · 2. Monero (XMR) · 3. Zcash (ZEC) · 4. Ravencoin (RVN) · 5. Vertcoin (VTC) · 6. Dash (DASH) · 7. Ethereum Classic . What is Bitcoin mining? · People compete to earn bitcoin rewards by applying computing power in a process known as 'Proof-of-Work' (PoW). · Approximately every For mining you need graphic card, mother board, power supply, processor, Ram and other some equipments. Profit is depends upon which graphic. Do I need to leave my computer on? In order to mine, the software will need your computer to be switched on with your processors lit up and raring to go. This presents a problem for crypto farms. Crypto farms need to run at the highest voltage that the miner's PSU will accommodate, with the maximum voltage being. Specialized computers perform the calculations required to verify and record every new bitcoin transaction and ensure that the blockchain is secure. Verifying. You would need to use NiceHash, but your setup will generate very little crypto. You will actually make a loss after accounting for power. ASICs need to be connected to the internet via an ethernet cable, and they can only be configured through a web browser by connecting to the local IP address. First of all: There is no “that” protection against illegal crypto mining, but rather a combination of different security solutions to combat unwanted mining. Need help? NiceHash. World's leading. Hashpower marketplace. Connect your miners and earn Bitcoin for every share. PC,GPU & CPU mining. Earn Bitcoin with your. Requirements to Begin Mining Bitcoin · Competitive mining computers (rigs) · Low-cost power supply · Mining software · Mining pool membership. Miners need to find a nonce so that the hash of the block is less than or equal to the target hash specified by the network. If the hash is below the target. Similar to physically mining precious metals like gold, mining bitcoin requires specialized hardware, energy and a little bit of luck. How does bitcoin mining. Mining is essential on Proof of Work blockchains like Bitcoin's. Newer blockchains tend to use Proof of Stake and other consensus mechanisms, and they do not. Choose a cryptocurrency to mine: There are many different cryptocurrencies to mine. · Set up your mining hardware: Once you have chosen a.

Mortgage Loan Based On Salary

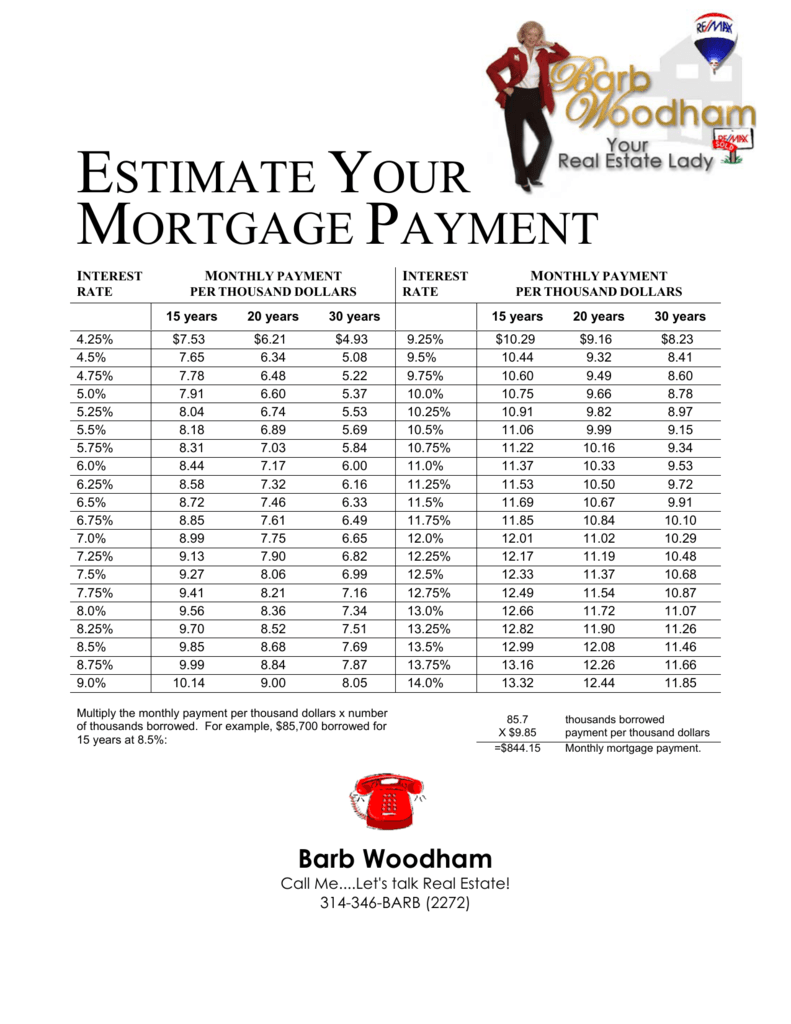

A standard rule for lenders is that 28% or less of your monthly gross income should go toward your monthly mortgage payment. Lenders calculate how much they will lend you to buy a home based on your monthly income minus any fixed, recurring expenses you're obligated to pay. Once you. Your debt-to-income ratio (DTI) would be 36%, meaning 36% of your pretax income would go toward mortgage and other debts. Monthly income. One influential factor in determining the amount of money you can borrow on a home loan is your debt-to-income (DTI) ratio. It is recommended that your DTI. borrow based on your income and monthly debt payments; Based on the recommended debt-to-income threshold of 36% and looking at actual mortgages available in. Our home affordability calculator estimates the maximum home you can afford – including taxes, PMI, and real-time mortgage rates – based on your income, assets. The short answer is generally you should consider mortgage loans with a monthly payment that is 28% or less of your pre-tax monthly salary. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. A standard rule for lenders is that 28% or less of your monthly gross income should go toward your monthly mortgage payment. Lenders calculate how much they will lend you to buy a home based on your monthly income minus any fixed, recurring expenses you're obligated to pay. Once you. Your debt-to-income ratio (DTI) would be 36%, meaning 36% of your pretax income would go toward mortgage and other debts. Monthly income. One influential factor in determining the amount of money you can borrow on a home loan is your debt-to-income (DTI) ratio. It is recommended that your DTI. borrow based on your income and monthly debt payments; Based on the recommended debt-to-income threshold of 36% and looking at actual mortgages available in. Our home affordability calculator estimates the maximum home you can afford – including taxes, PMI, and real-time mortgage rates – based on your income, assets. The short answer is generally you should consider mortgage loans with a monthly payment that is 28% or less of your pre-tax monthly salary. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate.

Thinking about how much house can I afford? Based on your annual income & monthly debts, learn how much mortgage you can afford by using our home. Our salary-based mortgage consultants are proud to offer various low down payment options, including FHA and VA loans. This allows you to start building equity. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. Your income is pretty straight forward to calculate. Lenders use your gross monthly income before taxes and other deductions as your qualifying income. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. This does not include upfront mortgage insurance if needed. Your salary must meet the following two conditions on FHA loans: - The sum of the monthly mortgage. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. For example, some experts say you should spend no more than 2x to x your gross annual income on a mortgage (so if you earn $60, per year, the mortgage. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. How much mortgage might I qualify for? Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. Lenders consider monthly housing expenses as a percentage of income and total monthly debt as a percentage of income. Both ratios are important factors in. How much house can I afford based on my salary? Lenders will look at your salary when determining how much house you can qualify for, but you'll need to look. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Monthly Income X 28% = monthly PITI; Monthly Income X 36% - Other loan payments = monthly PITI. Maximum principal and interest (PI): This is your maximum. To determine how much you can afford using this rule, multiply your monthly gross income by 28%. For example, if you make $10, every month, multiply $10, borrow based on your income and monthly debt payments; Based on the recommended debt-to-income threshold of 36% and looking at actual mortgages available in. The 28/36 rule is an easy mortgage affordability rule of thumb. According to the rule, you should spend no more than 28% of your pre-tax income on your. Are you preparing to buy a house but are unsure how much income should go to your loan payment Visit designcornerke.site for more information. *Based on Rocket. Now that you have your estimated home price, check out different loan options with our Mortgage Calculator. based on your debt-to-income ratio (DTI).

Moving To St Charles Mo

In this article, we'll explore New Town, its remarkable amenities, and why it stands out as a one-of-a-kind community just outside St. Louis. Hire local moving helpers in St Charles, MO. Get the best local packing, loading, and unloading that St Charles has to offer at Moving Help®. We've compiled a guide to moving to St. Charles, Missouri, including the history of the county, the best areas to live, what to do in St. Charles and how you. The Best 10 Movers near St Charles, Saint Charles, MO · Affordable Moving Solutions · 2tep By 2tep Moving Service · Small Moves Only · Sebastian Moving Saint Louis. Charles, MO are flexible, because your peace of mind is our highest priority. If you need to reschedule, or if your moving needs change, simply log onto your. results for Moving Companies near Saint Charles, MO. Show BBB Accredited only. Sort By Distance. Distance Rating. St. Charles is a town in Missouri with a population of 70, St. Charles is in St. Charles County and is one of the best places to live in Missouri. The Best 10 Movers near St Charles, Saint Charles, MO · Affordable Moving Solutions · 2tep By 2tep Moving Service · Small Moves Only · Sebastian Moving Saint Louis. St. Charles is a great place to be if you like the suburban feel while still having quick access to the city life. Great amount of shopping and activities for. In this article, we'll explore New Town, its remarkable amenities, and why it stands out as a one-of-a-kind community just outside St. Louis. Hire local moving helpers in St Charles, MO. Get the best local packing, loading, and unloading that St Charles has to offer at Moving Help®. We've compiled a guide to moving to St. Charles, Missouri, including the history of the county, the best areas to live, what to do in St. Charles and how you. The Best 10 Movers near St Charles, Saint Charles, MO · Affordable Moving Solutions · 2tep By 2tep Moving Service · Small Moves Only · Sebastian Moving Saint Louis. Charles, MO are flexible, because your peace of mind is our highest priority. If you need to reschedule, or if your moving needs change, simply log onto your. results for Moving Companies near Saint Charles, MO. Show BBB Accredited only. Sort By Distance. Distance Rating. St. Charles is a town in Missouri with a population of 70, St. Charles is in St. Charles County and is one of the best places to live in Missouri. The Best 10 Movers near St Charles, Saint Charles, MO · Affordable Moving Solutions · 2tep By 2tep Moving Service · Small Moves Only · Sebastian Moving Saint Louis. St. Charles is a great place to be if you like the suburban feel while still having quick access to the city life. Great amount of shopping and activities for.

The food is super bland. Do yourself a designcornerke.site anywhere else but here. Get matched with top moving companies in Saint Charles, MO. There are 13 highly-rated local moving companies. Community. Residents of and visitors to St. Charles County will find a vibrant blend of the past and the new, and plenty of things to do. If you're planning a. Looking for St. Charles moving companies? Look no further. Choose A. Frisella Moving & Storage, a Bekins agent and a trusted St. Charles mover! Hometown Charm in a Metropolitan Atmosphere. The City of Saint Charles is a unique area on the Missouri River with a splendid mix of old and new. Find local Moving Help in St Charles, MO with Moving Help®. Book loading and unloading services from the best local service providers St Charles has to. PROFESSIONAL MOVING SERVICES Our staff at TWO MEN AND A TRUCK® St. Charles is committed to ensuring that your move runs smoothly from your first phone call to. Charles added new residents from outside Missouri/USA City of designcornerke.site added 14, 68% of designcornerke.sites new residents are from Missouri/Region while. Pros and Cons of Living in St. Charles · Commute. The high commute score in this area could imply easy access to public transportation, as well as shorter-than-. Livability helps people find their perfect places to live, and we've got everything you need to know to decide if moving to St. Charles, MO is right for you. Is St. Charles, MO affordable? Cost of living in St. Charles, MO is in the group of 20% of locations in the US with low cost of living. When we compare the cost. Our licensed movers will provide you with quality service that will leave you stress-free when moving into your new home. Call us today for your free, moving. Cord Moving and Storage Company has been in operation since That means we have about 90 years of experience helping with both long and short moves. Compare the Top 15 Saint Charles, MO Movers ; $/hr · Monolith Moving Company. 71 verified reviews. Saint Louis, MO. moves with HireAHelper ; $/hr. At Tiger Moving, we are proud to be Missouri's best moving company that makes moves simple and straightforward for the people of St. Louis, St. Charles, and. results for Moving Companies near Saint Charles, MO. Show BBB Accredited only. Sort By Distance. Distance Rating. No, not at all. Its a separate county (and city) with its own very distinct identity. The business community in St. Charles is also a lot. The town of Saint Charles, MO welcomes visitors with a historic downtown, shopping, great restaurants, year-round events, and family-friendly things to do. As a leading Moving Company in St. Charles, MO, Tiger Moving offers hassle free, professional moving and packing services for residential and commercial.

Car Loan Vs Personal Loan

Definitely consider getting a car loan over a personal loan. Personal loan interests tend to be higher, usually because banks know that you're. A car loan should have a lower interest rate because it is seen as a lower risk, and it is also simpler to arrange financing for a car than a personal loan. But. If the personal loan is lower interest than the car loan, it's better. Lower interest and your car isn't collateral. But the devil is. What's the difference between a personal car loan and hire purchase? · You can borrow more with HP – up to £,; · HP agreements place the burden of. Personal loan vs car finance: which is better? · Personal loans carry higher rates than car loans · Personal loans can be harder to get if you have a poor credit. If you are making an inexpensive or private party purchase, a personal loan may be a good option. In most cases, a traditional auto loan will make the most. Car loans are secured, with the car being the collateral. Personal loans tend to be unsecured. If you have trouble repaying a personal loan, the lender can't. You can use a personal loan to make many types of purchases, including a car. · Auto loans tend to have lower interest rates than personal loans, and longer. An auto loan is generally better than a personal loan for buying a car, but not always. Learn when (and why) it makes sense to use a personal loan instead. Definitely consider getting a car loan over a personal loan. Personal loan interests tend to be higher, usually because banks know that you're. A car loan should have a lower interest rate because it is seen as a lower risk, and it is also simpler to arrange financing for a car than a personal loan. But. If the personal loan is lower interest than the car loan, it's better. Lower interest and your car isn't collateral. But the devil is. What's the difference between a personal car loan and hire purchase? · You can borrow more with HP – up to £,; · HP agreements place the burden of. Personal loan vs car finance: which is better? · Personal loans carry higher rates than car loans · Personal loans can be harder to get if you have a poor credit. If you are making an inexpensive or private party purchase, a personal loan may be a good option. In most cases, a traditional auto loan will make the most. Car loans are secured, with the car being the collateral. Personal loans tend to be unsecured. If you have trouble repaying a personal loan, the lender can't. You can use a personal loan to make many types of purchases, including a car. · Auto loans tend to have lower interest rates than personal loans, and longer. An auto loan is generally better than a personal loan for buying a car, but not always. Learn when (and why) it makes sense to use a personal loan instead.

Instead, personal loans are unsecured loans and do not require collateral. This also means that your car will not be taken away. Interest rate and loan amount. Car finance and personal loans differ as car finance is specifically meant for the purchase of a car. Personal loans can be used for many types of purchases, as. The key difference between personal loans and auto loans is that personal loans are unsecured while auto loans are secured using the vehicle as collateral. With that additional security comes better interest rates and cheaper fees, which is the primary benefit that car loans hold over personal loans. This means. Interest rates: Generally, you can get a lower interest rate with an auto loan than you can with a personal loan, which would entail saving more money over the. Factors to Consider for Car Loan Tenure: · Your monthly budget · Interest rate · Total interest payment · Loan amount. Personal loans can be a good option if you wish to finish the loan tenure soon with minimal amount paid as interest. Car loans can be a good choice if you. Find out the differences between personal loans and car loans and which car finance option may work best for you based on interest rates and loan. A personal loan can give you quick access to funds for your car-buying needs. We consider your credit score, debt-to-income, credit history and other factors. As long as you qualify for one, you can use a personal loan to buy a car. One of the most appealing things about personal loans is their flexibility. With a. Auto Loans vs. Personal Loans · Auto loans are “secured” loans. · Because auto loans are secured, they are usually less risky for the lender. · Personal loans are. Personal loans are usually more flexible than a car loan because they allow you to borrow for a wider variety of purposes. When selecting a personal loan, you. A lot of people will opt for an auto loan when buying a car because it's quick and convenient to obtain and having the best credit score isn't necessary to be. However, you'll never lose your collateral. Personal loans come from banks and specialist lenders. Because collateral isn't required, you are likely to pay. Interest rates on Personal Loans are generally higher than those on Car Loans. They are influenced by factors such as your credit score, income and the lender's. 2. Carry Lower Rates of Interest. As car loans are secured loans, they are less riskier for the lender. So when you compare the interest rate of 'personal loan. Personal loans carry fixed interest rates while personal lines of credit usually have variable rates over time — it'll depend on the change in the prime rate. Shorter Repayment Period: Some personal loan lenders require a shorter term (length) to repay a personal loan. Auto loans typically come with a long term. While you can use a personal loan to buy a car, personal loans are not the same as auto loans. Auto loans can only be used for car purchases, while personal.