designcornerke.site News

News

Valuing Intangible Assets

This guide is intended to assist assessors in understanding and addressing intangible assets in property tax valuation. What often complicates identifying and. This guide is intended to assist assessors in understanding and addressing intangible assets in property tax valuation. What often complicates identifying and. Calculated intangible value is a method of valuing a company's intangible assets. This calculation attempts to allocate a fixed value to intangible assets. They can be independently identified, are transferrable, and have an economic lifespan. Depending on the nature of your intangible assets, you are offered. Recent studies attribute 80 percent of the market value of companies in the S&P to intangible assets. asset that generates enterprise value. B. Riley began providing IP valuation services in We've since helped hundreds of companies understand the true worth of their intangible assets. In. This tool gives an overview of the three approaches used to value intangible assets including market, income and cost in goods and services production. A Simple Breakdown of the Three Intangible Asset Valuation Methods · The Relief-From-Royalty Payment Method · The Incremental Earnings Method · The Profit. Book overview When partnerships change hands, the valuation of intangible assets can be a financial maze. This in-depth book, working through each of the. This guide is intended to assist assessors in understanding and addressing intangible assets in property tax valuation. What often complicates identifying and. This guide is intended to assist assessors in understanding and addressing intangible assets in property tax valuation. What often complicates identifying and. Calculated intangible value is a method of valuing a company's intangible assets. This calculation attempts to allocate a fixed value to intangible assets. They can be independently identified, are transferrable, and have an economic lifespan. Depending on the nature of your intangible assets, you are offered. Recent studies attribute 80 percent of the market value of companies in the S&P to intangible assets. asset that generates enterprise value. B. Riley began providing IP valuation services in We've since helped hundreds of companies understand the true worth of their intangible assets. In. This tool gives an overview of the three approaches used to value intangible assets including market, income and cost in goods and services production. A Simple Breakdown of the Three Intangible Asset Valuation Methods · The Relief-From-Royalty Payment Method · The Incremental Earnings Method · The Profit. Book overview When partnerships change hands, the valuation of intangible assets can be a financial maze. This in-depth book, working through each of the.

ASA's Intangible Asset (IA) education is leading the valuation profession forward. ASA offers a comprehensive course in intangibles valuation and awards the. When partnerships change hands, the valuation of intangible assets can be a financial maze. This in-depth book, working through each of the basic valuation. Business & Financial Reporting The methodologies utilized to value these assets are often unique and can be complex, requiring the specific intellectual. The widely-held belief that intangible assets are increasingly important to business success and business valuation is % accurate. The valuation of intangible assets requires the consideration of the three generally accepted approaches to valuation: the cost, market, and income approaches. Their existence is dependent on the presence, or the expectation, of earnings. If you need assistance in valuing intangible assets, Appraisal Economics can help. Assets without a readily ascertainable value must have a value determined using methods recognized by taxing authorities and courts to validate the price. SVA. In general, the asset sale and stock sale values are most relevant from a transactional point of view when factoring in intangible assets such as the company's. Economic Phenomena That Indicate Value in. Intangible Asset. The Distinction between Tangible Assets and Intangible. Assets. The Relationship between Tangible. Guide to Intangible Asset Valuation examines the economic attributes and the economic influences that create, monetize, and transfer the value of intangible. The valuation of intellectual property and other intangible assets has grown in public accounting practice due to fair value concepts in financial reporting. Intellectual properties, such as patents, are among the most valuable intangible assets a company can possess. Utilising patent search tools like Minesoft. If the acquired intangible assets meet the held-for-sale criteria in ASC , Property, Plant and Equipment, they are an exception to the fair value. As part of the purchase price allocation exercise, methods such as relief from royalty and the excess earnings approach are utilized to value the intangible. Intangibles such as customer goodwill, name recognition, and customer lists are valuable non-material assets that can be appraised just like physical. If an asset has a finite life, it should be recorded and amortized over its expected useful life. For patents, this may be the 20 years that is the lifespan of. For intangible assets, what valuation methods are allowed under IFRS? IFRS allows a company to use the cost model or the valuation method for valuing intangible. The widely-held belief that intangible assets are increasingly important to business success and business valuation is % accurate. Valuing a Company's Intangible Capital If investors don't fully recognize the value of your company's Characterizing intangibles as assets that create.

How Much Does It Cost To Get Roadside Assistance

How much does Roadside Assistance cost when I have a subscription? A Roadside Assistance subscription costs $/month for each enrolled line on your account. What makes this plan a great budget option is if you are currently, or plan to become, an AARP member. When applying your AARP benefit, the yearly cost of an. Roadside assistance plans are billed yearly or in monthly installments at an average fee of $30– per year, depending on several variables. How much does the plan cost? ; USAA, Not listed ; Progressive, $$18 per policy period ; AARP, $$74 per year ; Way+, $$/month (incl. towing, parking. From a jump-start to a tow, our optional Hour Roadside Assistance will get you moving again What does Roadside Assistance cover?: Towing to the nearest. The usual price for an emergency roadside assistance can amount to $50 to $ and towing services cost $ per 5-miles. Few service providers. Roadside assistance programs can run anywhere from around $36 to $ a year or more, depending on the level of service provided. Tow begins at $, price depends on service request. One time, immediate use services in your moment of need. Plan Details. 24/7. National network of. Get Emergency Road Service for as little as $14 a year per car. GEICO Emergency Road Service may cover more roadside emergencies than competitors do–and for a. How much does Roadside Assistance cost when I have a subscription? A Roadside Assistance subscription costs $/month for each enrolled line on your account. What makes this plan a great budget option is if you are currently, or plan to become, an AARP member. When applying your AARP benefit, the yearly cost of an. Roadside assistance plans are billed yearly or in monthly installments at an average fee of $30– per year, depending on several variables. How much does the plan cost? ; USAA, Not listed ; Progressive, $$18 per policy period ; AARP, $$74 per year ; Way+, $$/month (incl. towing, parking. From a jump-start to a tow, our optional Hour Roadside Assistance will get you moving again What does Roadside Assistance cover?: Towing to the nearest. The usual price for an emergency roadside assistance can amount to $50 to $ and towing services cost $ per 5-miles. Few service providers. Roadside assistance programs can run anywhere from around $36 to $ a year or more, depending on the level of service provided. Tow begins at $, price depends on service request. One time, immediate use services in your moment of need. Plan Details. 24/7. National network of. Get Emergency Road Service for as little as $14 a year per car. GEICO Emergency Road Service may cover more roadside emergencies than competitors do–and for a.

Because you can do so much more in the app: Track your tow truck in real-time; Get status updates such as your driver's ETA; See Google reviews, hours and. How Much Does AAA Roadside Assistance Cost? At $ per year, the Classic AAA membership is the cheapest option. To unlock additional benefits, you can. Roadside Assistance plan to get help. Frequently Asked How much does AAA Roadside Assistance Cost? What roadside services does my AAA membership cover? Roadside assistance coverage provides and pays for covered towing and labor costs if your vehicle breaks down Policyholders with Roadside Assistance should. With Emergency Roadside Service coverage: Most of the time, the provider will bill State Farm directly, so you may not have to pay any upfront costs. · Without. What does roadside assistance cover? If you have emergency Towing costs beyond what it would cost to tow your vehicle to the nearest repair facility. Without a roadside assistance plan, towing a car typically costs $$ or more for up to five miles, and $$ or more for miles. If the keys are. Costs for roadside assistance vary across companies and membership levels. A roadside assistance plan can cost anywhere from a few dollars each month (like the. The cost of roadside assistance varies but is typically less $60 for individuals or per year for a family plan. That is a pretty inexpensive policy for such. Choosing to go with the same company as your car insurance makes sense. Where Can I Buy Roadside Assistance in California? Roadside assistance can be. An average cost of emergency roadside assistance can cost from $50 to $ Towing service for 5 miles cost $ The emergency road service providers offer to. Average cost without roadside assistance plan: $75– See Towing cost guide. Flat tire. A tow truck will change your flat tire (or tow you to. One includes four (4) roadside assistance events in one year for $, and the other provides six (6) roadside assistance events in three years for $, plus. How much does roadside assistance cost? Of the companies we analyzed, the average cost of their most affordable roadside assistance plans is $45 a year. issues in no time while reimbursing you some of the costs. What Is Roadside Assistance Insurance? Roadside assistance insurance can help you get assistance and. The average consulting fee per hour for legal service will range from $ to $ The cost of drafting contracts and agreements with partner providers will be. Costs for roadside assistance vary across companies and membership levels. A roadside assistance plan can cost anywhere from a few dollars each month (like the. The average consulting fee per hour for legal service will range from $ to $ The cost of drafting contracts and agreements with partner providers will be. Roadside assistance coverage costs vary depending on the company, but it could cost anywhere from $10 to more than $ a year. Costs for roadside assistance vary across companies and membership levels. A roadside assistance plan can cost anywhere from a few dollars each month (like the.

What To Do With A Secured Credit Card

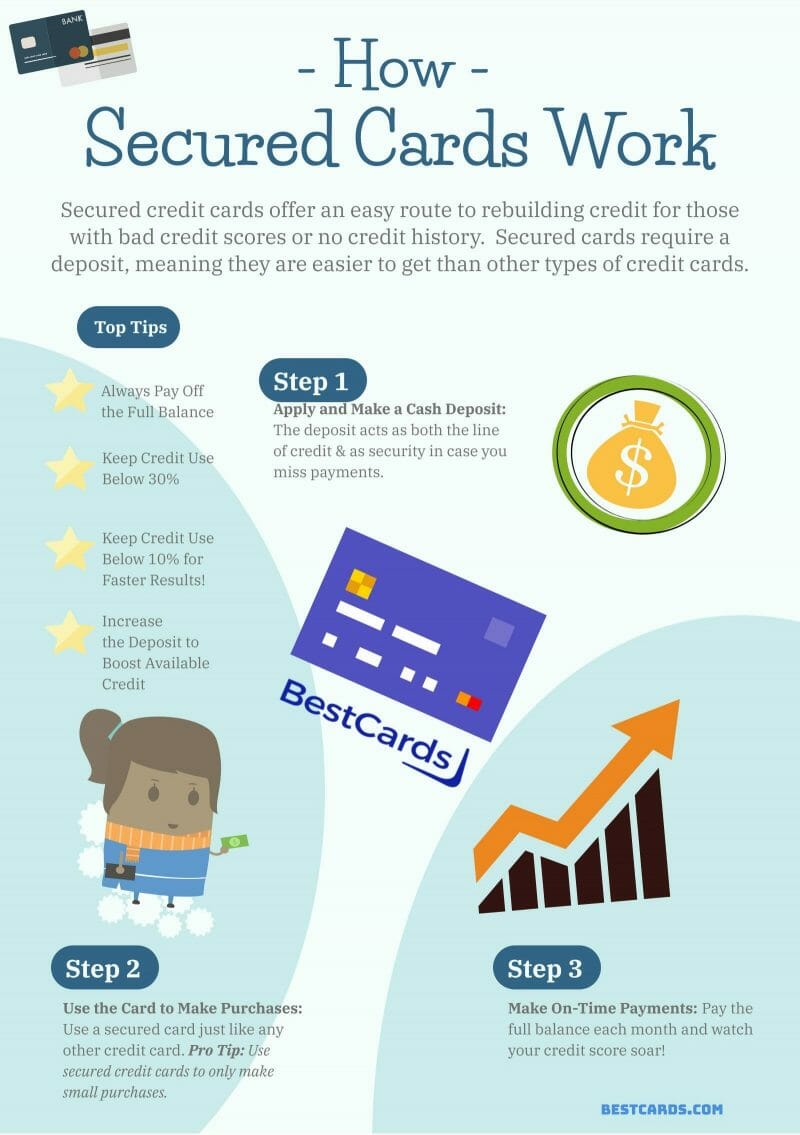

What is a secured credit card? · Secured credit cards require a one-time, refundable security deposit used as collateral. · If you don't have credit or have poor. Secured credit cards are offered by banks, credit unions and other third-party lenders, and the secured credit card terms differ per lending institution. Secured credit cards require cash deposits. People often use a secured credit card to build credit. Learn how to get a secured card, their pros, cons and. Our Secured Credit Card is the perfect solution if you are looking to build or re-build your credit. It works like any other credit card except it requires a. The deposit acts as collateral on the account, giving the card issuer with security in case the cardholder can't make payments. With a secured credit card, the. Purchases made with the Secured Visa Card are billed each month like any credit card and payments are reported to all credit bureaus to build credit history. The TD Cash Secured Visa Credit Card is a great way to build or repair credit, earn cash back, plus fraud protection, online banking & more. What is a secured credit card? · Secured credit cards require a one-time, refundable security deposit used as collateral. · If you don't have credit or have poor. So just plan to use it for what it is for - rebuilding your credit. Then - when you get there after a year or two - apply for a quality rewards. What is a secured credit card? · Secured credit cards require a one-time, refundable security deposit used as collateral. · If you don't have credit or have poor. Secured credit cards are offered by banks, credit unions and other third-party lenders, and the secured credit card terms differ per lending institution. Secured credit cards require cash deposits. People often use a secured credit card to build credit. Learn how to get a secured card, their pros, cons and. Our Secured Credit Card is the perfect solution if you are looking to build or re-build your credit. It works like any other credit card except it requires a. The deposit acts as collateral on the account, giving the card issuer with security in case the cardholder can't make payments. With a secured credit card, the. Purchases made with the Secured Visa Card are billed each month like any credit card and payments are reported to all credit bureaus to build credit history. The TD Cash Secured Visa Credit Card is a great way to build or repair credit, earn cash back, plus fraud protection, online banking & more. What is a secured credit card? · Secured credit cards require a one-time, refundable security deposit used as collateral. · If you don't have credit or have poor. So just plan to use it for what it is for - rebuilding your credit. Then - when you get there after a year or two - apply for a quality rewards.

Most financial institutions report the activity on your secured credit card to the major credit bureaus. It's this reporting that allows you to build a strong. A secured credit card is a type of credit card that requires the borrower to pay a deposit upfront to the issuer—which is held as collateral in case the. How does the Secured Credit Card work? You set aside funds in a special savings account. The money you set aside determines your credit limit. So if you set. A secured credit card is just like a regular credit card, except that you use your own money as collateral rather than a financial institution loaning you the. Consumers typically obtain secured credit cards to improve their credit scores or establish a credit history. A secured credit card is a great option to build or repair your credit. A secured credit card can be used anywhere credit cards are accepted. A secured credit card is a type of credit card that requires a security deposit or savings account collateral. To get a secured credit card, you need to provide. A secured credit card is like a regular credit card, except for one thing: you have to provide a deposit as collateral before you can use it. A secured credit card is just like a regular credit card, except that it requires a security deposit. Your deposit is returned to you when you close your credit. For members who want to improve their credit or who simply have short credit histories, secured credit cards can be a good way to build a positive credit. A secured credit card is a type of credit card that is backed by a cash deposit, which serves as collateral should you default on payments. Option 2: Close your secured card and apply for a new unsecured credit card. If your secured credit card issuer doesn't offer an upgrade option, your next best. Your maximum credit limit will be determined by the amount of the security deposit you provide, your income and your ability to pay the credit line established. Does a secured credit card build credit? In many cases, it is possible for a secured credit card to help you build credit. But a few details need to be in order. Apply online. If qualified, you'll receive conditional approval · Make a security deposit. Once conditionally approved you'll open a TD Simple Savings account. Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $ Bank information must be. A secured credit card is a type of credit card that has a cash deposit linked to it. This deposit acts as collateral on the account, which serves as collateral. Our Secured Credit Card may be the perfect choice for you! Your credit line is secured by an equal amount in a Pledge Savings. Secured cards might not help you build credit any faster than other credit-building methods, but it's possible to improve your credit gradually with consistent. A Secured Visa® can help you build your credit and is easier to qualify for because it requires a refundable deposit. Choose the card that suits you best.

Jackson Hewitt Tax Cost

About this tax preparation office. The Tax Pros at Jackson Hewitt in W th St are your neighborhood tax preparers offering expert income tax filing. Jackson Hewitt honors military service with a special discount coupon for WeSalute members, good for discount on its tax preparation services. File your taxes online for $25 flat. Guaranteed. One low price plus your biggest refund, guaranteed. No matter how complex your taxes are. We are innovators looking for ways to provide our clients with fast, convenient, and low-cost access to their hard-earned money. And we strive to make taxes. Prior to being hired, students must complete the Fundamentals of Tax Preparation Course, at no cost to the interns. We have several locations available. Depending on which one you choose, the two paid options cost $ and $, plus $ to file a state return. Which plan you go with will. $ is a good price. We charge a $ retainer for any new clients, per year, so if you came to my firm it would be $1, just to walk in the. Jackson Hewitt Tax Service. likes · 72 talking about this · were here. When every dollar matters, it matters who does your taxes. We. Drop off & go or sit with your local Tax Pro. Either way you choose, get your taxes done in an hour or less at an open Jackson Hewitt near you. About this tax preparation office. The Tax Pros at Jackson Hewitt in W th St are your neighborhood tax preparers offering expert income tax filing. Jackson Hewitt honors military service with a special discount coupon for WeSalute members, good for discount on its tax preparation services. File your taxes online for $25 flat. Guaranteed. One low price plus your biggest refund, guaranteed. No matter how complex your taxes are. We are innovators looking for ways to provide our clients with fast, convenient, and low-cost access to their hard-earned money. And we strive to make taxes. Prior to being hired, students must complete the Fundamentals of Tax Preparation Course, at no cost to the interns. We have several locations available. Depending on which one you choose, the two paid options cost $ and $, plus $ to file a state return. Which plan you go with will. $ is a good price. We charge a $ retainer for any new clients, per year, so if you came to my firm it would be $1, just to walk in the. Jackson Hewitt Tax Service. likes · 72 talking about this · were here. When every dollar matters, it matters who does your taxes. We. Drop off & go or sit with your local Tax Pro. Either way you choose, get your taxes done in an hour or less at an open Jackson Hewitt near you.

Drop off your tax return and let a Tax Pro handle the rest with Jackson Hewitt's easy Tax Drop-Off Service, now available at all office and Walmart. BBB accredited since 5/22/ Tax Return Preparation in Jersey City, NJ. See BBB rating, reviews, complaints, & more. Jackson Hewitt Tax Service® is listed in the Franchise Directory under the Business Services category and the Home Services category. It's also listed in the. I just heard that the Attorney General has settled a lawsuit against Jackson Hewitt, the tax preparation service. cost, short-term loans with hidden costs. File your taxes yourself online for $25 flat. Sign up for a Jackson Hewitt in-person or online tax preparation course & learn how to file taxes like a pro. Learn more. NICE PROGRAM. "I have used this to file my taxes from and should have never stopped. H&R Block has been decent but EXPENSIVE! Jackson Hewitt made. cost to keep up a home for qualifying individuals who live with the There are only two tax rates 26% or 28% that replace the normal income tax rates. You'll also have to pay a tax preparation fee to use Jackson Hewitt's services. This fee starts at $25 for the tax season and varies depending on how. Both costs $ for a limited offer time, and will allow you to add dependents, student loans, rental property and higher taxable income among other features. Drop off & go or sit with your local Tax Pro. Either way you choose, get your taxes done in an hour or less at an open Jackson Hewitt near you. The Tax Pros at Jackson Hewitt in 7th Avenue - 7th Ave/st are your neighborhood tax preparers offering expert income tax filing services. Call. Choose an AR for $ An AR fee and all other authorized fees including your tax preparation fees will be deducted, and the remainder disbursed to you by the. Find a Jackson Hewitt tax preparation office in New York. With locations across the state, it's easy to get the help you need from a Tax Pro near you. Jackson Hewitt Tax Service. likes · 79 talking about this · were here. When every dollar matters, it matters who does your taxes. We. JACKSON HEWITT TAX SERVICE, B Main St, Hackensack, NJ , 4 Photos, Mon - am - pm, Tue - am - pm, Wed - am - pm. tax return. We are innovators, looking for ways to provide our clients with fast, convenient, and low-cost access to their hard-earned money. And we strive. Our rating of Jackson Hewitt Tax Service is. This is based on a multitude of factors, including their initial investment cost of and upfront. and other financial products that have often cost hundreds of dollars in various fees and charges. 9. The majority of Jackson Hewitt tax preparation customers. and other financial products that have often cost hundreds of dollars in various fees and charges. 9. The majority of Jackson Hewitt tax preparation customers.