designcornerke.site Gainers & Losers

Gainers & Losers

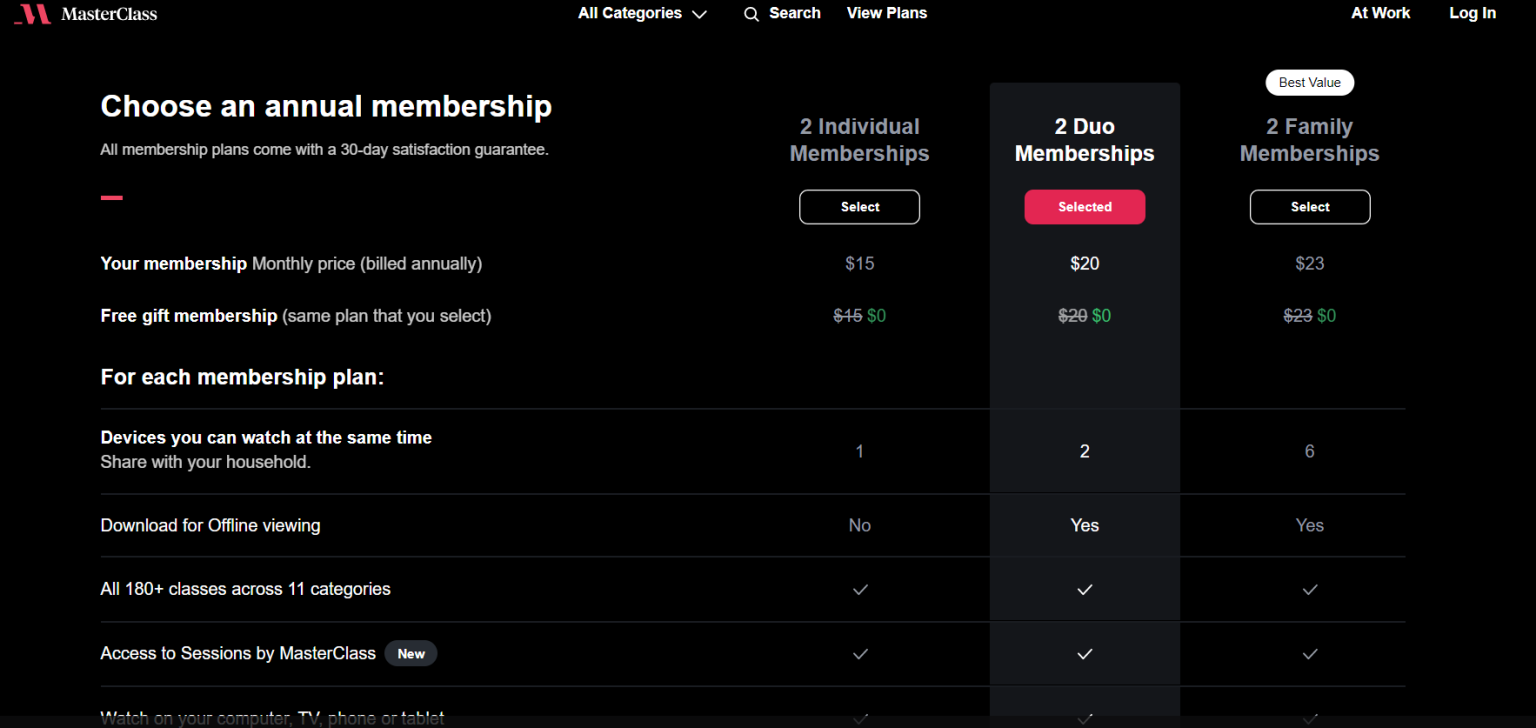

Masterclass Yearly Cost

MasterClass claims you can start learning on its platform for $15 per month. But did you know that this pricing goes higher for a different membership? Yanka Industries, Inc., doing business as MasterClass, is an American online education subscription platform on which students can access tutorials and. MasterClass offers online classes created for students of all skill levels. Our instructors are the best in the world. How Much is MasterClass? Subscription Pricing & Special Offers · Individual Plan. Their subscription plan starts at $10 per month, billed at $ annually for. Choose an annual membership. All membership plans come with a day satisfaction guarantee and include the following: Choose from + classes across It features over 11K online video courses as of June , each with its own price. Users can also access selected content through an annual subscription of. How much does MasterClass cost? MasterClass offers annual memberships starting at $ billed annually, which unlocks unlimited access to all classes, including. What brings you to MasterClass today? Develop my career or leadership skills. Become a better actor, musician, or writer. Here's a breakdown of the yearly costs: Standard Plan (1 device): $10/month or $/year — Perfect if you're the sole user and don't plan to. MasterClass claims you can start learning on its platform for $15 per month. But did you know that this pricing goes higher for a different membership? Yanka Industries, Inc., doing business as MasterClass, is an American online education subscription platform on which students can access tutorials and. MasterClass offers online classes created for students of all skill levels. Our instructors are the best in the world. How Much is MasterClass? Subscription Pricing & Special Offers · Individual Plan. Their subscription plan starts at $10 per month, billed at $ annually for. Choose an annual membership. All membership plans come with a day satisfaction guarantee and include the following: Choose from + classes across It features over 11K online video courses as of June , each with its own price. Users can also access selected content through an annual subscription of. How much does MasterClass cost? MasterClass offers annual memberships starting at $ billed annually, which unlocks unlimited access to all classes, including. What brings you to MasterClass today? Develop my career or leadership skills. Become a better actor, musician, or writer. Here's a breakdown of the yearly costs: Standard Plan (1 device): $10/month or $/year — Perfect if you're the sole user and don't plan to.

As for pricing, Masterclass comes in at $ for its one-year All-Access Pass. Read my in-depth review of Masterclass to see if it's right for you. How much does it cost? Your 1 year all-access membership to masterclass is $49, which is equal to $4 a month. Cancel anytime. How does it work? How much does it cost? Our monthly subscription is 29$/month. Yearly membership is $16/month (billed annually), and our most beneficial option is Yearly DUO. $ (annual individual membership fee) / 20 courses = $6. And if you join Check out our MasterClass review or MasterClass cost articles to see how. That depends. The annual fee can feel a bit steep, but considering the vast library of classes, it breaks down to a pretty good deal if you take. How much does MasterClass cost? MasterClass offers annual memberships starting at $ billed annually, which unlocks unlimited access to all classes, including. The Duo plan costs $ per year (or $20 per month). It lets you watch Masterclass courses on two devices at the same time. In addition, it allows you to. MasterClass Pricing: How Much is it? MasterClass costs $ per year for full access to + courses, workbooks, and the MC community. There's no free trial. It is offered at a price point of $ for the year for the unlimited access option. It gives unlimited access to all of their classes and new ones that are. There is no "individual" subscription in MasterClass, only Standard, Plus, and Premium. None of the values match those subscription plans either. Standard is $6. Cost: How much does MasterClass cost? · Value: Are the classes worth the investment? · Individual Classes: Can you buy specific courses without a. MasterClass costs $ $ per year, which is cheaper than most learning platforms. Pros. Excellent production value of. For an individual, this plan costs $10 per month if you pay annually. From my experience, this plan is completely worth it as you will get access to the courses. It depends on how you look at it. Consider the anchoring effect I learned from Chris Voss' MasterClass. If your first point of reference is the price of your. What does it cost? You can get a MasterClass All-Access Pass for only $ for a year of access. That works out to $10/month, though it's billed annually as. $16/month Billed at $ per year. Workbooks for every class Maximize your progress with our downloadable workbooks for every class, featuring bonus content. After , when it reached the new milestone of earning more than $ million in revenue, the highest revenue generated by designcornerke.site after COVID So for those in the USA, Skillshare costs $32 a month or $ a year, but almost always offers discounts on annual subscriptions. These discounts can range from. Pricing: Skillshare's annual subscription often runs around $, sometimes with discounts available. Vibe: Less focused on those celebrity instructors, more. What makes Master Class cost $6,? We have considered raising the price Why is Master Class only held once a year? Joe works with our team of.

Best Asx Trading App

My ASX allows you to monitor and manage your portfolio for Australian Securities Exchange, ASX in your mobile phone. It features an easy to use interface. Looking for the best broker for your global investments? Webull brings you a trading App that has next to nothing fees and famouly advanced marke. Powerful stock tracking tool for Australian Stock Markets. Track Stocks and Indices from Australian Securities Exchange (ASX) at one place. Moomoo is an intuitive investment and trading platform with a professional set of tools, data and insights. When you sign up with Moomoo and open a brokerage. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Finally, moomoo holds the best international trading platform award for Chinese stocks. International investors will find each global trading platform opens the. Webull is a low-fee trading app that gives you access to ASX and US shares, US options and shares from emerging Asian economies. ASIC regulates it in Australia. CommSec is a brokerage platform operated by a division of the Commonwealth Bank of Australia (ASX: CBA). It has been around for a very long time and it's the. My ASX allows you to monitor and manage your portfolio for Australian Securities Exchange, ASX in your mobile phone. My ASX allows you to monitor and manage your portfolio for Australian Securities Exchange, ASX in your mobile phone. It features an easy to use interface. Looking for the best broker for your global investments? Webull brings you a trading App that has next to nothing fees and famouly advanced marke. Powerful stock tracking tool for Australian Stock Markets. Track Stocks and Indices from Australian Securities Exchange (ASX) at one place. Moomoo is an intuitive investment and trading platform with a professional set of tools, data and insights. When you sign up with Moomoo and open a brokerage. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Finally, moomoo holds the best international trading platform award for Chinese stocks. International investors will find each global trading platform opens the. Webull is a low-fee trading app that gives you access to ASX and US shares, US options and shares from emerging Asian economies. ASIC regulates it in Australia. CommSec is a brokerage platform operated by a division of the Commonwealth Bank of Australia (ASX: CBA). It has been around for a very long time and it's the. My ASX allows you to monitor and manage your portfolio for Australian Securities Exchange, ASX in your mobile phone.

Online Share Trading Platforms Comparison · Moomoo | Share Trading Moomoo logo · CMC Invest | CMC Invest Share Trading - Standard CMC Invest logo · IG Australia. CommSec is one of the most popular and widely used trading apps in Australia. The app offers a broad range of features and tools for both beginners and. AvaTrade. AvaTrade is another respectable and regulated broker licensed and controlled by the CySEC and the ASIC, two top-tier regulators. It provides MT4, MT5. Top Australian Brokers · Types of Automated Trading · Copy Trading · eToro – Best for Copy Trading · MetaTrader4 · IC Markets – Best for MetaTrader 4 · MetaTrader5. Best online trading platform · CMC Markets - $0 brokerage up to $1, per stock per trading day (e.g. buying $ VAS and $ VGS on the same. Sign up for the ASX Options Trading Game. Try out the sandbox before the game kicks off on 21 October. Register now Markets. Top 5. Announcements. Sectors. >. Our Favourite Investing Apps (for Specific Purposes) · Hatch: Best App or Platform for Low-Cost Investing in the US Markets · Tiger Brokers (NZ): Best Low-Cost. Top-Rated share trading platforms on Canstar's database for casual investors ; Interactive Brokers Australia, Share Trading ; Moomoo AU, Moomoo ; Saxo Capital. Rated Best Value Share Trading Platform; Premium features at no additional cost; Low brokerage and investment minimum. Frame Australia's Happiest. eToro was the first trading platform to offer unconditional $0 brokerage ASX stock trades, but now charges a still-competitive US$2 fee on all stock trades. In short, CMC is one of the best-rated ASX trading platforms if you know what you're doing, otherwise, novices will be better suited to eToro which is. Two massive markets. One powerful platform. As a former commsec user, I love how easy the app is to navigate and with ASX now available switching between. Tiger Trade: Buy US&ASX shares I have been trying to sell one of my position for 2 years now and everytime the stock is performing good, Tiger Brokers is not. The best trading app on-the-go ; Australian market. Trade Aussie shares & ETFs ; US market. Trade Wall St stocks & ETFs round-the-clock, 24 hours a day including. Because of its robust feature set and strict adherence to Australian legislation, eToro is on my list as the top trading platform. With its Australian Financial. eToro's large selection of investments, user-friendly platform, and unique features make it our top overall pick. Begin your financial journey with Sharewise's Powerful Trading App, designed to give you an all-in-one trading experience. Trade on the ASX, access real-time. An app with an intuitive interface that's easy to use not only helps to simplify a complicated process, but also saves you time when trading. This provides. NTP is ASX's trading platform providing access to a range of futures and options products listed on the ASX 24 market. NTP Technical library. Discover our award-winning trading app for Android¹ and our progressive web app for iOS – including the features on offer and how to start trading.

Heloc And Home Equity Loan

Home Equity Lines of Credit (HELOC) are variable-rate lines. Rates are as low as % APR and % for Interest-Only Home Equity Lines of Credit and are. A HELOC is a revolving line of credit that allows homeowners to access funds as needed within a specific draw period, typically 5 to 10 years. Home equity loans offer the stability and predictability of fixed rates and payments, while HELOCs provide ongoing access to money when you need it. As with any. As opposed to our lump-sum home equity loans, a HELOC gives you access to a revolving line of credit once the loan is approved. You will then have the. With a fixed monthly payment and low fixed interest rate, a home equity loan from LAFCU may be your best choice when it comes to using the equity in your. Learn the ins and outs of a home equity loan vs. a home equity line of credit (HELOC) to decide which option is best for you. A home equity line of credit (HELOC) lets you borrow against available equity with your home as collateral. Processing times are currently estimated to take 45 to 55 calendar days to close on a new home equity loan or Home Equity Line of Credit (HELOC) once we receive. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better. Home Equity Lines of Credit (HELOC) are variable-rate lines. Rates are as low as % APR and % for Interest-Only Home Equity Lines of Credit and are. A HELOC is a revolving line of credit that allows homeowners to access funds as needed within a specific draw period, typically 5 to 10 years. Home equity loans offer the stability and predictability of fixed rates and payments, while HELOCs provide ongoing access to money when you need it. As with any. As opposed to our lump-sum home equity loans, a HELOC gives you access to a revolving line of credit once the loan is approved. You will then have the. With a fixed monthly payment and low fixed interest rate, a home equity loan from LAFCU may be your best choice when it comes to using the equity in your. Learn the ins and outs of a home equity loan vs. a home equity line of credit (HELOC) to decide which option is best for you. A home equity line of credit (HELOC) lets you borrow against available equity with your home as collateral. Processing times are currently estimated to take 45 to 55 calendar days to close on a new home equity loan or Home Equity Line of Credit (HELOC) once we receive. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better.

Home equity loans and HELOCs both use the equity in your home—that is, the difference between your home's current value and how much you still owe on your. A HELOC is a line of credit that lets you to withdraw funds when you need, borrowing against the equity in your home. A home equity line of credit, aka HELOC, lets you borrow what you need when you need it based on the value of your home. With a home equity loan or home equity line of credit (HELOC), your goals are within reach. Get funds to pay for a variety of expenses. The main difference between a home equity loan1 and a HELOC is that in a home equity loan, you get an upfront lump sum that you repay in fixed payments, whereas. A home equity loan, or a closed-end second mortgage, is a solution to get cash for a one-time need and specific loan amount, eg, remodeling your kitchen. What is a home equity line of credit (HELOC)? A U.S. Bank HELOC allows customers to borrow funds on an as-needed basis using the equity in your home. A home equity loan and a HELOC differ in how credit is provided and the type of interest rate involved. As with a home equity loan, a HELOC typically allows you to borrow up to 85% of your home equity. A HELOC, however, has a variable interest rate, which means. Unlike a home equity loan that provides a one-time lump sum of cash, a HELOC allows you to draw funds from your equity, up to a set amount, whenever you need. Like home equity loans, you use your home as collateral for a HELOC. This can put your home at risk if you can't make your payments or they're late. And, if. Get your personalized rate for a Home Equity Line of Credit up to $K with Citizens FastLine, the simpler, faster way to get a HELOC. Today's mortgage rates, refinancing, mortgage calculators, home equity, first-time home buyers, home improvement loans, home buying guide, mortgage help and. A HELOC works similar to a credit card in that you are approved for a set amount of credit to use (based on the equity in your home), but you do not have to use. The average rate on a home equity line of credit (HELOC) dropped to percent as of Aug. 28, according to Bankrate's survey of large lenders. Home equity. Fifth Third Equity Flexline®. A Home Equity Line of Credit (HELOC) lets you access money as you need it—now and in the future. Both HELOCs and Home Equity Loans are similar in the sense that you are borrowing against the equity of your home. A home equity loan comes in a lump sum. A HELOC has a variable rate and allows borrowing multiple times, up to your credit limit. A home equity loan allows you to borrow a lump sum at a fixed. With a HELOC, you can borrow against a portion of your total equity. Typically, lenders allow you to borrow a total combined amount of 75 to 90% of your home's. HELOC rate ranges from % APR to % APR as of 8/1/ and is based on the Prime Rate in effect on the last day of the previous month, plus or minus your.